Recurring FedNow instant transactions

What is Recurring FedNow instant transactions

RecurringFedNow and Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank, B2B, B2C and C2B account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions.

Recurring FedNow instant transactions for your business using Real-Time Payments

When dealing with recurring FedNow instant transactions using real-time services, both the payee (recipient) and the payer (sender) need specific elements for effective transaction management. Here's how these elements might appear for both parties:

Payee Side (Receiving Payment):

- Recurring Payment Profile: The payee sets up a recurring payment profile specifying details such as the payment amount, frequency, start date, and end date (if applicable).

- Payment Amount: The fixed or variable amount to be received for each recurring transaction. The payee defines this amount when configuring the recurring payment profile.

- Payment Frequency: The interval at which payments are expected, such as daily, weekly, monthly, or custom intervals. The payee selects the desired frequency when setting up the recurring payment profile.

- Payment Start Date: The date on which the recurring payments will commence. The payee specifies this start date when configuring the recurring payment profile.

- Payment End Date (if applicable): The date on which the recurring payments will cease, if there is a predetermined end to the payment schedule. The payee may optionally specify an end date when setting up the recurring payment profile.

- Payment Instructions: Any specific instructions or details provided by the payee regarding the recurring payments, such as account information or payment terms. These instructions may be included in the payment profile or communicated separately.

Payer Side (Making Payment):

- Authorization: Confirmation from the payer indicating their consent to initiate the recurring payments as requested. This authorization may be provided upfront when the payer sets up the recurring payment profile.

- Payment Frequency: The interval at which payments will be made, corresponding to the frequency specified by the payee. The payer ensures that payments are initiated according to the agreed-upon schedule.

- Payment Amount: The fixed or variable amount to be paid for each recurring transaction. The payer ensures that the correct amount is transferred for each payment, as specified in the recurring payment profile.

- Payment Start Date: The date on which the recurring payments will commence, as specified by the payee. The payer initiates payments starting from this date based on the recurring payment profile.

- Payment End Date (if applicable): The date on which the recurring payments will cease, if specified by the payee. The payer ensures that payments are not initiated beyond this end date, adhering to the terms set in the recurring payment profile.

- Payment Execution: The actual transfer of funds from the payer's account to the payee's account for each recurring transaction. This may occur automatically according to the schedule defined in the recurring payment profile.

By incorporating these elements into real-time services for recurring FedNow instant transactions, both the payee and the payer can efficiently manage payments, ensuring accuracy, compliance, and convenience in the payment process.

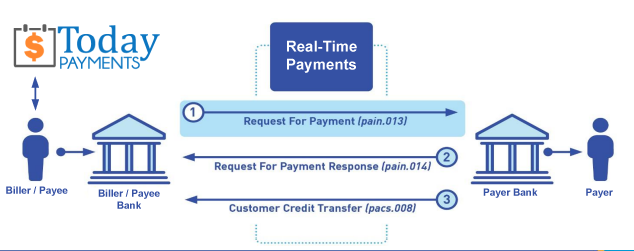

Creation Request for Payment Bank File

Call us, the .csv and or .xml Real-Time Payments (RTP) or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing